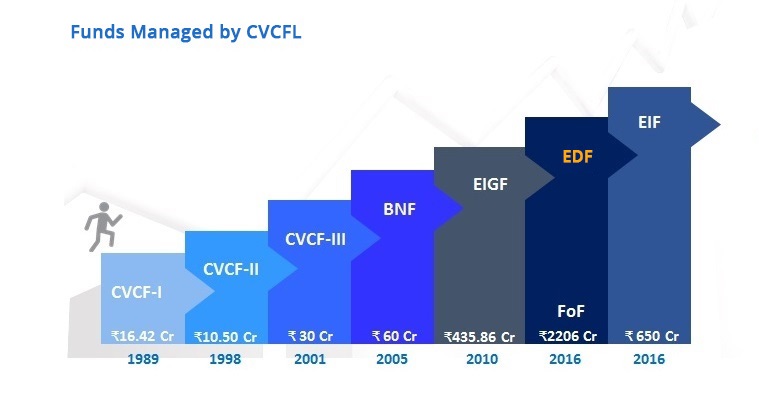

Funds Managed by CVCFL

Canbank Venture Capital Fund Ltd (CVCFL) has so far managed five funds/schemes with a total corpus of INR 553 crores and Electronic Development Fund ( Fund of Funds) of INR 2206 crores.

Canbank Venture Capital Fund Ltd (CVCFL) has so far managed five funds/schemes with a total corpus of INR 553 crores and Electronic Development Fund ( Fund of Funds) of INR 2206 crores.

CVCF I - Set up in 1989 with a corpus contributed by Canara Bank, Canbank Financial Services Ltd and the World Bank. The term of the fund has expired and the fund is closed.

CVCF II - Set up in 1998 with a corpus solely contributed by Canara Bank and the fund is in the final stages of its divestments.

CVCF III - Set up in 2001 with a corpus contributed by Canara Bank and SIDBI. The term of the fund has expired and is closed

CVCF IV or Bharath Nirman Fund - Set up in 2005 with a corpus contributed by Canara Bank, leading Public Sector Banks and SIDBI and is presently in divestment mode.

Emerging India Growth Fund (EIGF) Fifth Fund of CVCFL. Canara Bank is the anchor investor and rest of the contributions by domestic PSU Banks/ financial institutions and insurance companies. EIGF is a general domestic fund with a broad base of diverse sectors, with its prime focus on extending assistance to units in SME sector and investments in industries with positive outlook. The Fund is in divestment mode.

Canbank Venture Capital Fund Limited ("Investment Manager") is launching a scheme of the Trust, i.e., Empower India Fund as the ("Fund").

The Fund's investment objective is to generate superior and consistent risk-adjusted returns and long-term capital appreciation for its investors by primarily investing into equity, quasi equity, equity linked instruments, warrants, debt, convertible/non-convertible debt instruments and other instruments such as preference shares, conditional/convertible/non-convertible debentures of Indian enterprises as permitted under the AIF Regulations.

The Fund is a sector agnostic fund and may invest inter alia in mid and late stage enterprises with an option to invest in start-up enterprises, small and medium enterprises, early stage companies.

The Fund's investment process/work plan will include:

Screening

The Investment Manager will screen the proposals received from prospective investee companies and select/ identify/ recommend the eligible proposals. The Investment Manager will undertake the preliminary screening of the prospective investee companies through the in-house team of the Investment Manager.

Proposal Scrutiny Committee (PSC)

The shortlisted prospective investee companies will be placed before the Proposal Scrutiny Committee (PSC) for evaluating the preliminary investment proposals and reports as prepared by the Management Team based on its preliminary due diligence on the proposed portfolio company.

Non-Binding-Term Sheet Upon approval by the Proposal Scrutiny Committee, the Investment Manager shall issue the nonbinding Term Sheet to the prospective investee company covering the terms of investment. The matter is taken to the next stage for the purpose of detailed due diligence upon acceptance of the Non-Binding Term Sheet within the time frame by the prospective investee company.

Due diligence The Investment Manager shall get the detailed due diligence done by assigning the exercise to one of the empanelled due diligence agencies The due diligence shall entail an assessment of the management team, business plan, the system & process in place, compliance of legal &statutory regulations, the target market, the potential competitors and a thorough review of the business model.

The due diligence process is normally categorized into the following main heads viz.

- Financial, Accounting and Taxation

- Commercial & Valuation

- Legal & Secretarial Compliance

After the due diligence the proposal shall be forwarded by the Investment Manager to the Investment Committee for its final approval or otherwise.

Investment Committee

The investment proposals along with recommendations of the Investment Manager, Proposal Scrutiny Committee and the findings of the due diligence will be placed before the Investment Committee for its final sanction/ decision.